Finding the Gap: Aligning Market Demands with Business Opportunities

- admin0914730

- Jan 30

- 9 min read

Updated: Jan 30

By: Mason McDonald

For the entrepreneur, it is the dream to come up with the next “big” thing. Whether that is a new product or invention that the world has never seen before, creating the next social media network, or solving a problem that’s never been solved, the entrepreneur has a desire to find a gap in the market and fill it.

For the developer, it is the dream to take a raw piece of land and complete the necessary entitlements and horizontal improvements to make the land buildable. Not as sexy as creating a new app that you sell for over a billion, I know, but many of the richest people I know are residential developers. There are residential developers that are at the mom-and-pop level as well as developers that are household names. A common theme for the actions that all these developers are taking is that they are finding a gap in a market where there is not enough shovel-ready land, and filling that gap by taking the raw piece of land through all the necessary steps to be able to build on it and provide housing.

However, there is another common theme between the mom-and-pop developers as well as the biggest names in the industry: there is a significant gap between acquiring the land and the ability to take it through the development process. That gap is financing.

In last month’s newsletter, I focused primarily on why land loans are hard to find and how there is tremendous opportunity to provide the capital for land flippers (people who buy land cheaply and sell it for more). In this article, I aim to focus on the opportunities that exist in the current market due to the shortage of single family homes in the USA and the opportunities of providing capital to developers that are attempting to take a raw piece of land and develop it.

The Gap Between US Housing and Population Growth

If you keep up with news within the real estate world, I’m sure you have seen countless headlines over the last few years that are along the lines of: “US Real Estate Market Crashing!” and “US in Severe Housing Shortage”. The thing to note about both of those article headlines is that they inspire a lot of fear which leads to clicks which leads to ad revenue for the journalist; however, if you’re aware of how economics work, you can notice that those two headlines contradict each other. In an effort to not overcomplicate all of the factors that can lead to a recession or depression, usually if there is a lack of supply and a high amount of demand, that particular sector in a market is safe. Below, I’ll highlight three primary drivers to the supply issues and the reasons for the demand of new construction in the U.S.

World Events and Their Contributions

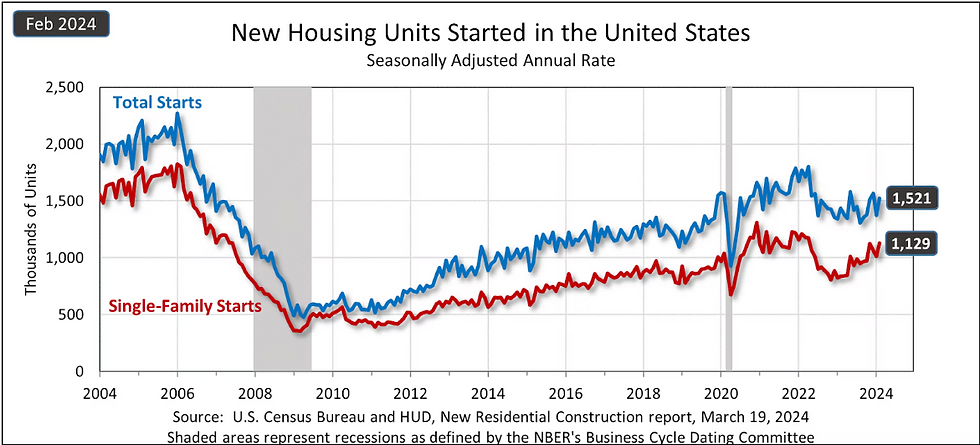

In 2007-2008, the real estate market completely collapsed due to many horrible practices and many developers and builders lost everything. When that occurred, new construction came to an almost immediate halt. If you look at the graph below that depicts new construction starts, you can see the steep drop that occurred during The Great Recession.

For the next decade, developers and builders slowly started to correct and you can see a slow increase to get to a more normalized level of new construction. In 2020, another world event caused a drop in new construction. The COVID-19 pandemic shut the world down and the US saw another dip in new construction and while it corrected quickly, there were other implications of the pandemic that are not indicated in this graph.

Since COVID had effects throughout the world, and since we operate in a global economy in which many building materials are shipped in from out of the country, we had a significant disruption in the supply chain for materials. Combining government shutdowns, business shutdowns, extreme and deadly illness, along with a labor and material shortage, it is the perfect storm for another slowdown in new construction. So while the data indicates a continued increase in new units being constructed, the factors listed above have contributed to significant delays with the units being completed rather than just started.

Long Standing Regulations

The United States is known as the land of the free and home of the brave but if you drive through suburbia, it might feel more like some sort of dystopian (or utopian depending on your preferences) society that you don’t see in other parts of the world. If you walk down the street in many European cities, you will pass by a single family home next to a bakery next to an apartment complex next to a shopping mall next to a restaurant. In the USA, experiencing something like that is very rare due to many long standing zoning laws that are in place.

I do believe that there is importance with there being regulatory involvement with development and understand the desire of preservation of certain communities being a certain way; however, with many of the laws in place in the more severely zoning regulated states (i.e. Connecticut, New York, Arizona), it halts development. See the Connecticut zoning map below that shows how much of the state is zoned primarily for residential. In many areas where there are nicer or more luxury developments, the residents will do everything in their power to stop larger multifamily development from being allowed anywhere close by. I do have empathy for everyone involved in these situations and I believe most people have a desire for a majority of Americans, especially those considered as part of the working class that allows a city to function, to be able to have an affordable place to live. Yet, I believe that many Americans will hold the idea for the need of affordable housing but also have the NIMBY (Not In My Backyard) attitude […Google the drama associated with affordable housing projects in Jackson, WY].

The positive news is that for the past 5-7 years, many states have been focusing on reforming these zoning laws to allow for more sustainable development opportunities. This will help reduce the development timeline and increase the land available for new housing to be constructed.

The Surge in Demand from Millennials and Immigrants

There are many factors that have contributed to the population increases, decreases, and growth rates in the United States. The invention of birth control, the COVID-19 pandemic, a cultural change in the idea/expectation of having children, the cost of living, immigration, and anything else you can think of. Regardless of all these factors, the population of the United States is getting older and with an aging population, the demand for housing increases.

The average age for first time homebuyers in the U.S. in 2022 was 36 according to the NAR and historically that number has been in and around the early to mid 30s. Knowing this statistic, it is finally the millennial generation’s time to purchase homes. In addition to millennials flooding the market, there is an increasing number of immigrants coming into the United States that is causing a surge in demand for new housing (see the image below). These two factors, along with the hesitation in sales for recently bought homes in 2020-2021 due to the historically low and locked-in mortgage rates that these people have, is another driver for the higher-than-supply-level demands for new housing.

The Gap Between Capital and Development

In the wake of a tumultuous period for the banking industry, including the subprime mortgage crisis (2007-2010), failed developments following the 2008 crash, and recent bank collapses in 2023, regulators have significantly tightened scrutiny and banks have become more risk-averse. Construction loans have always been expensive and difficult to come by, but with all of these additional factors coming into play, it has become even more difficult for developers to secure funding for their projects.

If you go back and look at the graph that shows “New Housing Units Started in the United States”, you can see the uptick that occurred in new development in the latter half of 2020 through 2022. With many of these projects being in the commercial/multifamily space and there being a sharp increase in interest rates for all mortgages, lending institutions that provided the capital for these development projects have become stuck with holding the loans for longer periods of time than expected because of the decrease in buyers due to the higher interest rates. Therefore, many of the larger lenders that have the capability of financing large scale development projects have put a halt to funding, or simply extremely unfavorable lending criteria, in place towards this asset class.

These converging factors – supply shortages, homeowner reluctance to sell due to low rates, rising demand, and developer financing struggles – create a significant market gap, presenting a substantial opportunity.

The Opportunity

Similar to the converging factors listed above that explain why there is an opportunity within the space to provide capital to developers, there is a similar converging of factors that have occurred within mine and Dan’s businesses that allow this opportunity to be realized. While there are tremendous macro and socioeconomic trends that indicate the desire for capital in the development space, the driving forces behind the creation of Ground Up Partners were the frustrations that Dan, myself, and dozens of our friends that are in the land investing and/or flipping community have experienced. In starting a new business venture, there is a certain amount of validation that occurs when anecdotal evidence at the small level (other land flippers), and personal experience, is validated by data as well as anecdotal evidence at the large level (the nation’s largest developers).

Where We Are

To fully explain what Ground Up Partners does in its current state of operations: we joint venture with land flippers by providing the capital necessary and expert-level guidance and deal underwriting/due diligence to complete the acquisition for a parcel, or parcels, of buildable land at a substantially discounted price compared to the market value in exchange for a share of the profit upon the sale of the parcel(s). The criteria for any deal Ground Up Partners completes is as follows:

The sale price will be above $20,000 for each individual parcel.

There are verifiable comparable sales within the same area for the parcel(s).

All necessary due diligence to ensure the feasibility of building on the land has been completed and verified.

Ground Up Partners will hold the parcel(s) in its name through a warranty deed.

The typical profit split that Ground Up Partners offers to our “deal providers” is anywhere from 30-60% depending on the available profit spread within the deal. The capital that we provide for these deals come from a mix of sources to include, mine and Dan’s own, as well as many of you who are receiving this distribution. Since beginning operations in December 2023, Ground Up Partners has provided the capital to, or is currently in agreement with, six individual deal-providing partners for the acquisition of eleven parcels of land. The total acquisition price of all 11 parcels is approximately $313,233.58 with an estimated market value of $604,200.00 and a total profit potential of $235,084.73 after associated closing costs. The realized profit on the first two deals that have closed was $43,555.00 on a land acquisition basis of $69,146.31–this is prior to payment of debt service and payout to the deal finding partners.

Between Dan and myself, we have completed several hundred land deals and by understanding the market-specific due diligence required for each parcel we are acquiring and knowing the local experts to assist in every transaction, we are able to successfully mitigate risk in every transaction we’re completing. The true value that we are adding to each stakeholder involved in each transaction is connecting the gap between the passive investor with capital and the dealmaker that cannot raise money through expert guidance and risk mitigation.

Where We Are Going

Myself and Dan are firm believers of the saying “you need to walk before you run”, and that’s what we have done through our own businesses as well as Ground Up Partners. Through our individual businesses as well as combined through Ground Up Partners, Dan and I have successfully raised and deployed around $4.0MM. Prior to raising any money in our own businesses, however, we made and used all our own capital in all our own deals. Prior to using other investors’ capital to fund deals, we funded deals ourselves. Through years of work and hundreds of deals under our belt, we have created a track record of success and identified the true gaps in the market where the greatest opportunities exist.

However, while we believe it has been necessary to bootstrap and build our individual and combined businesses from the ground up (hence the name of our company), do smaller deals at a greater volume, and raise money in a non-systematic way on a deal-by-deal basis, we are looking forward to the future of getting involved in larger deals and raising capital through a more formalized investment vehicle for our passive investors. As outlined in the writings above, there is a gap for the small-time land flippers all the way up to the largest developers in the country that we will continue to capitalize on. We’re truly grateful for all the investors that have believed in us, our operations, and the returns we have provided over the years and we’re excited to take you with us to the next level. More on this to come…

Comments